Nexo Card

- Enjoy up to €20,000 in FREE foreign transactions, based on loyalty tier

- Generous ATM withdrawals up to €10,000 monthly

- Your crypto acts as collateral only, you do not actually sell it

- Amazing card overall

- No cons, except credit card interest if unpaid within a month

-

Key Features

| Visa or MC | |

|---|---|

| Debit or Credit | Credit Card, Debit Card |

| Denominated In | € EUR |

| Apple Pay | Enabled |

| Monthly Fee | 0.00 EUR |

| Monthly Inactivity Fee | 0.00 EUR |

| Interest Rate | 0% – 13.9% APR |

| Crypto to EUR Crypto->EUR Conversion Cost | ~0.75% |

| Highest Cashback | up to 2% |

| Entry-Level Cashback | 0.5% |

| Entry-Level Cashback Monthly Cap | 50 EUR |

| Daily Spending Limit | 10,000 EUR |

| Daily ATM Withdrawal Limit | 2,000 EUR |

| Foreign Exchange Fee | 2% |

| Crypto to Fiat Conversion | Auto on Every Purchase, Manual when Repaying |

| Crypto Asset Management | Custodial (stores crypto keys on your behalf) |

| Supported Countries | AustriaBelgiumCyprusCzechiaGermanyDenmarkSpain |

| Supported Cryptocurrencies | 1INCHAAVEADAALTAPEAPTARBATOMAVAXAXSBATBCHBNBBOMEBONK |

Your Nexo Card: Enjoy unique debit/credit switch mode with low crypto to fiat conversion cost

Nexo Card Benefits and Rewards

Nexo offers up to 2% cashback for card transactions. The higher your Loyalty level, the higher the cashback you will receive. Loyalty level is based on what % of your crypto holdings on the Nexo platform consist of NEXO Tokens. See the table below for details.

Base |

Silver |

Gold |

Platinum |

|

| Required Nexo Holdings | 0% – 1% of Your Crypto Portfolio | 1% – 5% of Your Crypto Portfolio | 5% – 10% of Your Crypto Portfolio | Above 10% of Your Crypto Portfolio |

| Cashback in NEXO Tokens | 0.5% | 0.7% | 1% | 2% |

| Cashback in Bitcoin | 0.1% | 0.2% | 0.3% | 0.5% |

| Monthly Rewards Limit | €50 | €100 | €150 | €200 |

The rewards are paid out in NEXO coin or BTC (Bitcoin), depending on your preference. You can switch between the two as often as you like.

Reality Check While Nexo Card promotes up to 2% cashback, if you're an entry-level user with 1,000 EUR in assets, you'll qualify for 0.5% cashback, capped at 50 EUR per month.

Are other cards more generous at base tier? No, they are not. In fact, Nexo Card offers more value for the entry-level user, than most competitors:

| Nexo Card | Industry Average1 | |

| Entry Level Cashback | 0.5% | 1% |

| Entry Level Cashback Monthly Cap | 50 EUR | 35 EUR |

Nexo Card is a Debit Card and a Credit Card

Very Cool:Nexo Card is a unique dual-mode card, which you can switch to be either a debit card or a credit card. When in the debit mode, Nexo Card is connected to your chosen crypto coin balance on Nexo platform. When in the credit mode, your crypto will be used as collateral, so you don't have to convert your crypto in advance, nor when spending with the card.

Alongside, Nexo offers you a personal bank account. You'll receive a Malta-based IBAN bank account number issued in your name.

Not so Great:Third party senders cannot deposit funds into your Nexo bank account - you can only receive deposits from accounts in your name. This means you will not be able to receive your fiat withdrawals from exchanges or receive salary payments.

It Comes in Both Physical and Virtual Forms

You can get Nexo Card in both physical and virtual versions, a feature only available with 30% of crypto cards. They'll mail you the physical card, and you can instantly get the virtual card online after completing KYC Identity Verification.

Wondering about the perks of each card type? Here are some highlights:

Physical Card | Virtual Card |

|---|---|

| ATM Withdrawals | Second Card Number |

| Required for Car Rentals, Hotels | Instant Availability |

| Useful When Phone Dies, or no Wifi | Freeze for Safety |

| Backup Payment Method | Set Lower Spend Limits |

Cost to Order: 0 EUR (available when you have $500 in assets) | Cost to Order: 0 EUR (available when you have $50 in assets) |

You will find the physical Nexo Card useful for in-person purchases, while the virtual card will be perfect for online transactions like subscriptions.

The back of Nexo Card

| Card Issuer | DiPocket |

|

BIN Number ⓘ

BIN number is the first 8 digits of the card and identifies the card issuer.

| 53084968 |

| Validity Period | 3 years |

| Issuing Country | Bulgaria |

Crypto-to-EUR Conversion Cost with Nexo Card

in Credit Mode: Doesn't Require Crypto Conversion to EUR

With Nexo Card in Credit Mode, you will not need to convert your crypto in advance, nor when spending using the card. When you set it to credit mode, your crypto will be used as collateral only. The time you will likely convert your crypto to real-life currency is when you'll be paying off the card at the end of the month.

in Debit Mode: Converts Your Crypto on Demand

Nexo Card offers instant conversion to EUR at the time of purchase, when in Debit mode. This allows you to hold your crypto and exchange to real-life currency only when you need to. No need to pre-convert your cryptocurrencies or preload the card.

Low Cost:Compared to the average ~1.7% crypto-to-fiat cost of other cards, converting crypto with Nexo Card is much more cost-effective (~0.75%). This means that you will get more EUR for your crypto when using this card.

From all crypto cards we reviewed for Europe, WhiteBIT Card, Holyheld Card and Trade Republic Card offer the cheapest crypto-to-fiat conversions (~0.28%, ~0.5% and ~0.7% respectively), while converting crypto with OWNR Card will cost you the most, ~4.64%.

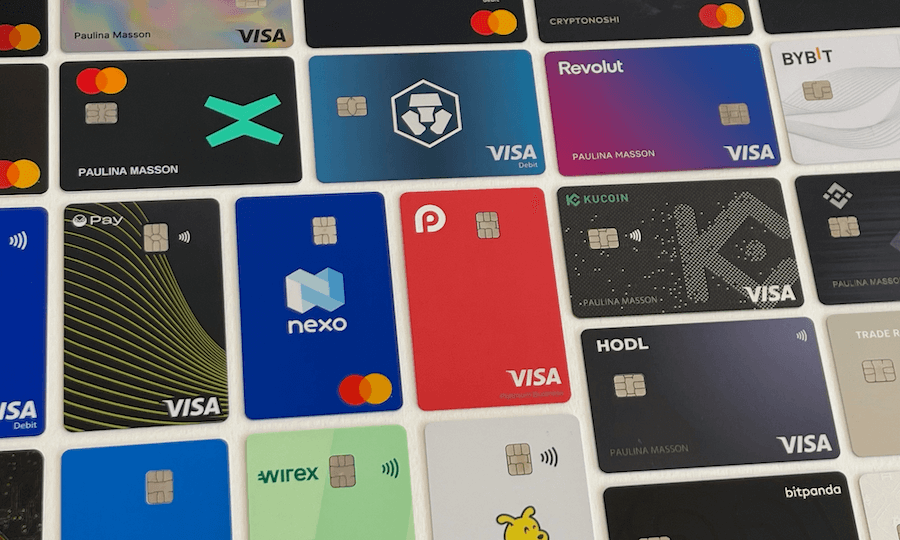

How Does Nexo Card Compare to Other Crypto Cards?

Nexo Card ranks #1 out of 63 amongst all the crypto cards we have reviewed so far. This makes it the absolute winner in its category.

We compared Nexo Card with 42 similar crypto cards, available for the same geographical region. See the resulting pros and cons below.

Strongest Features Against Competitors

Here are the strongest features of Nexo Card against its 42 competitors:

- Offers up to 50 EUR per month in cashback for entry-level users (exceeding the competitors' 35 EUR average).

- Provides a substantial ATM widthdrawal allowance of 2,000 EUR per day (average amongst other cards is only 500 EUR).

- Supports 86 cryptocurrencies (while other cards support an average of 15).

- Solid company with a 8.5/10 brand authority score (the average for all competing cards is 6/10).

- You can get both a physical card and a second virtual card (while 70% of competing crypto cards offer only one type - either physical or just virtual).

- Offers free ATM withdrawals for up to 2,000 EUR per month (which is very generous comparing to the average of 200 EUR free withdrawal limit offered by other cards).

- Their crypto-to-fiat conversion cost, including all related fees and spread, is among the lowest at ~0.75% (versus an average of ~1.8% with other cards.)

- Their overall fees & limits structure is incredibly generous, with a score of 7.8/10 (average fees & limits structure rating amongst other cards is 5.7/10).

Weakest Features Against Competitors

Compared to its 42 competitors, here are the shortcomings of Nexo Card:

- Offers up to 2% cashback (while other cards give an average of 4%).

- Daily spend is capped at 10,000 EUR (while other cards offer 25,000 EUR daily spend limit on average).

Nexo Card vs. Gnosis Card vs. Ledger CL Card

Nexo Card

|

Gnosis Card

|

Ledger CL Card

|

|

|---|---|---|---|

| Monthly Fee | 0.00 EUR | 0.00 EUR | 0.00 EUR |

| Crypto to Fiat Cost | ~0.75% | 0% + Gas Fees | ~2.25% |

| Highest Cashback | up to 2% | up to 5% | up to 2% |

| Entry-Level Cashback | 0.5% | 2% | 2% |

| Daily Spending Limit | 10,000 EUR | 8,000 EUR | 15,000 EUR |

| Daily ATM Limit | 2,000 EUR | 500 EUR | 2,000 EUR |

| Foreign Exchange Fee | 2% | 0% | 1.5% |

| Asset Management | Custodial | Non-Custodial | Custodial |

Availability for  United States United States |

|||

| Supported Cryptocurrencies | 86 | 2 | 7 |

| Apple Pay | Enabled | Not Enabled | Enabled |

| Customer Service | Great | Great | Great |

| Brand Authority | Well-Known | Growing | Well-Known |

If you plan to use your card for daily purchases, then daily spending limit is an important consideration for you. Ledger CL Card offers the highest daily spending limit of 15,000 EUR. You will get lower daily limits with Nexo Card and Gnosis Card.

Cashback rewards are a great way to earn back some of the money you spend on your card and is an important consideration as well. Out of the three, Gnosis Card offers the best cashback rewards of up to 5%. The cashback rewards for Nexo Card and Ledger CL Card are not as high.

To make a good choice, look through all features, as it is an individual choice. If you will mostly do online transactions with this card, then Apple Pay availability may not be a very important feature for you. If you travel a lot, foreign exchange rate will matter. And so on.

Nexo Card ATM Fees: The Real Cost of Cashing Out

Local ATM Withdrawals in EUR

Here's a breakdown of the fees you'll face when making local ATM withdrawals with your Nexo Card:

Starting with an initial amount of 200 EUR in ETH, the ATM withdrawal with Nexo Card will cost you a total of ~8.47 EUR (4.2% of 200 EUR), resulting in a final cash withdrawal of 191.53 EUR in hand.

Doesn't Nexo Card Offer Free ATM Withdrawals?

Yes, Nexo offers free ATM withdrawals for up to 2000 EUR per month (which is substantially higher comparing to the average of 200 EUR free withdrawal limit offered by other cards).

When they say 'free', they are only referring to their ATM Withdrawal Fee, which will be waived for the first 2000 EUR withdrawn per month. In our example, if you withdraw 200 EUR, this waiver saves you 3.97 EUR, reducing your local ATM withdrawal cost to around 4.5 EUR, compared to the standard cost of approximately 8.47 EUR.

International non-EUR ATM Withdrawals

Things will get significantly worse for International ATM Withdrawals. If you're out of country and cashing out with your Nexo Card, here's what it will look like:

For an international withdrawal using your Nexo Card with an initial 200 EUR in ETH, you'll incur fees totaling ~18.4 EUR (9.2% of 200 EUR), leaving you with 181.6 EUR in the equivalent foreign currency.

Reality CheckCompared to other crypto cards, Nexo Card is more cost-effective for both local and international ATM withdrawals:

| Cost with Nexo Card | Cost with Other Cards | |

| Local ATM Withdrawals | ~8.4 EUR (4.2% of 200 EUR) | ~9.2 EUR (4.6% of 200 EUR) |

| International ATM Withdrawals | ~18.4 EUR (9.2% of 200 EUR) | ~18.6 EUR (9.3% of 200 EUR) |

From all crypto cards that we reviewed, Trade Republic Card, Holyheld Card and Bit2Me Card offer the cheapest local ATM withdrawals (2.2%, 2.5% and 2.7% of 200 EUR respectively), while OWNR Card scores the worst, landing last on the list with a total local ATM withdrawal cost of 9% of 200 EUR.

We Tested Nexo's Customer Support

We asked Nexo's customer support different questions, and then rated their responses to evaluate how good their support is.

Why should you Care:When you'll have a money-related question, like a missing deposit or being overcharged - having good support at that moment will be crucial for you.

Nexo offers support via the following channels:

| Chat | https://nexo.com/ |

| [email protected] | |

| Web Form | https://support.nexo.com/s/contact?language=en_US |

Location: Nexo customer service reps are located in  Bulgaria.¹

Bulgaria.¹

| Support Channel | Our Interaction | Score |

Email (replied in 1 d 23 h ) | Answered the question about dispute process clearly, explained the steps required. | High Competence Not Personalized Flawless English, Professional Tone 9/10 |

Web Form (replied in 3 d 11 h ) | Reassuring reply to a question about card security. Good answer, but a late one. | Late Reply High Competence Not Personalized Flawless English, Professional Tone 7/10 |

Web Form (replied in 4 d 14 h ) | Late reply to a question about Apple Pay SMS verification code not arriving. Responded in detail, with the next steps to take. | Late Reply High Competence Highly Personalized Flawless English, Professional Tone 8/10 |

Chat (replied in 1 min) | Super quick responses, concise and to the point. | High Competence Not Personalized Flawless English, Professional Tone 9/10 |

Email (replied in 6 h 32 min) | A fantastic response - detailed, knowledgeable, informative. Question was about Foreign Exchange fees for a specific transaction. | High Competence Highly Personalized Flawless English, Professional Tone 10/10 |

To summarize,

Competence and Problem-Solving: Nexo's customer service agents are highly competent, so you can expect every issue to be resolved with professional expertise and a thorough understanding.

Customer Love: Their responses will be personalized when they need to look up specific information from your account, although they may not always address you by name.

Reply Speed: Response times are inconsistent, ranging from as quick as 1 minute to as slow as 5 days.

Overall Customer Service Rating: 8.6/10

This excellent score places Nexo's Customer Service well above the crypto card industry average of 7.2/10.

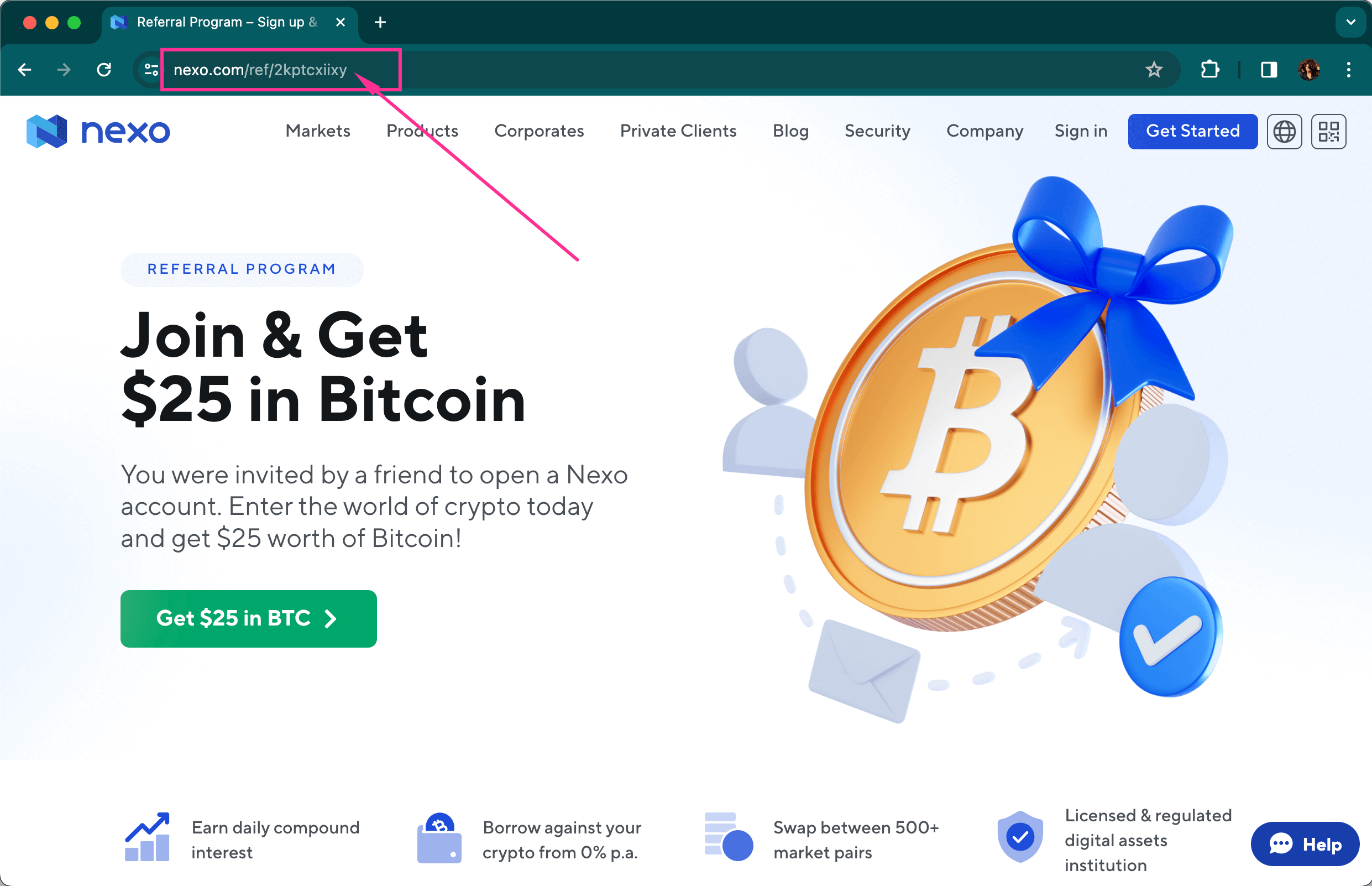

Nexo Referral Code - to Get 25 EUR Bonus

You can use referral code 2kptcxiixy to get 25 EUR bonus when you create an account on Nexo platform.

Here's how you can enter the referral code:

..or, just click here.

Your bonus will be paid out to you in BTC (Bitcoin), right after you top up your account with the first 100$.

p.s. Are we getting paid for referring you? Yes, and it helps us continue our mission. It's like you are buying us lunch 🍱 for all the hard work we've put into building this site. We really appreciate it. Thank you. 🙏🤗

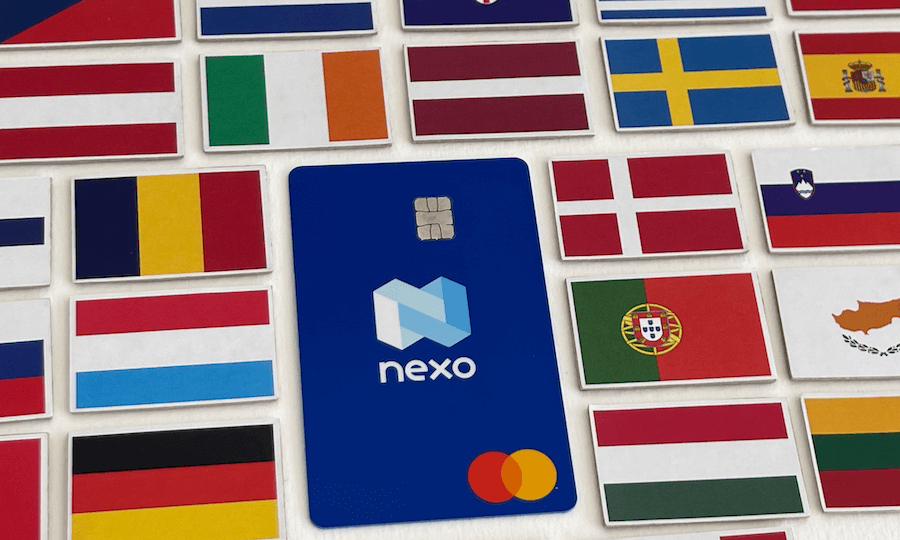

Nexo Card supports 25 countries

Is Nexo Card Available for Residents of United States?

No, Nexo Card is not available for residents of United States.

Nexo Card supports the following countries: Austria, Belgium, Croatia, Cyprus, Czechia, Denmark, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, The Netherlands.

To see our list of available crypto cards for 🇺🇸 United States, see this list. There are currently 12 cards listed there.

You may also be interested in this article: Crypto Cards for USA: The Best Options for Americans.

IBAN

IBAN